By Megan Sayles, AFRO Enterprise Author, msayles@afro.com

The fifteenth annual MBE Evening in Annapolis came about on Feb. 22, assembling native political leaders, members of the Legislative Black Caucus of Maryland and the minority enterprise neighborhood. The convention exists to reveal minority enterprise enterprises (MBEs) to financial and procurement alternatives within the state.

Former Maryland Del. Herman Taylor, who based MBE Evening in Annapolis in 2009, opened up this system by discussing his devotion to supporting minority-owned companies.

“I’m steadfastly obsessed with minority enterprise inclusion and entrepreneurship as a result of it provides folks energy—not energy over different folks however energy over themselves,” mentioned Taylor. “It provides them energy to regulate their very own lives, which is what we name self-determination, to allow them to create their very own alternative and future and reside their very own dream.”

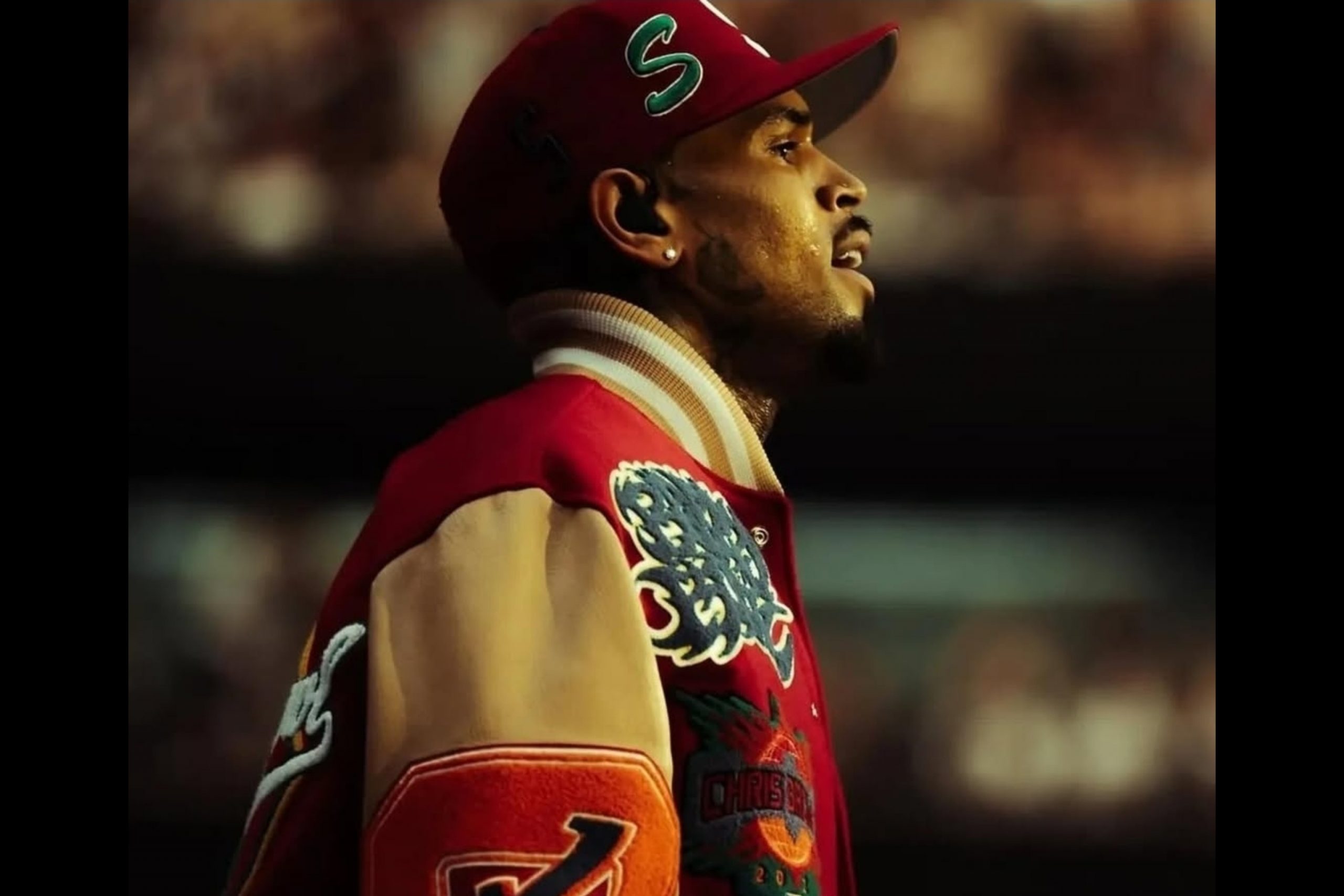

Gov. Wes Moore additionally gave remarks through the occasion. He reiterated his administration’s dedication to strengthening Maryland’s MBE program and holding state businesses accountable for complying with the state’s aspirational objective of 29 p.c MBE participation on authorities contracts.

Moore additionally highlighted his latest appointment of Nichelle Johnson as Maryland’s first MBE ombudsman, who will likely be instrumental in resolving contract points between primes and MBEs and creating insurance policies to streamline MBE program compliance.

“I’m pleased with the truth that simply in our first yr, the Board of Public Works delivered $1.4 billion to MBEs, a $160 million improve in comparison with the yr earlier than even though we allotted $6 billion much less than the yr earlier than,” mentioned Moore. “There was a major improve in how we evaluated and made positive there was vital MBE participation in the best way that authorities {dollars} are allotted and handled.”

Minority enterprise homeowners heard from two outstanding Black CEOs on a panel overlaying progress and success through the convention. Del. Jazz Lewis (D-Pr. George’s) led the dialog with Warren Thomspon, CEO of Thompson Hospitality, and Doyle Mitchell, CEO of Industrial Financial institution.

Mitchell inspired entrepreneurs to make the most of Industrial Financial institution’s monetary literacy workshops and sources.

“A financial institution is a really cheap place to get sure monetary recommendation. Now we have debtors who continuously speak to the lenders, and once they hear, they have a tendency to do very nicely,” mentioned Mitchell. “Our job is to attempt to develop companies. The extra they develop, the extra we develop.”

Thompson mentioned his firm maintains a division devoted to partaking small and minority companies for contract work. The hospitality agency additionally aids entrepreneurs in getting licensed as MBEs with the Nationwide Minority Provider Improvement Council.

“It’s usually mentioned, ‘It’s lonely on the prime,’ and it’s,” mentioned Thompson. “I believe any good chief will understand that and encompass himself or herself with sensible people who find themselves keen to offer you good recommendation and let you know if you’re messing up.”

Megan Sayles is a Report For America corps member.